Global crypto investment YTD inflows reach record $14.9 billion driven by Bitcoin ETFs

This record was achieved following a third straight week of inflows that totaled $1.05 billion last week. Notably, the ETPs’ trading volumes rose by 28% to $13.6 billion during the reporting period, a significant departure from the subdued activities seen in previous weeks.

Meanwhile, James Butterfill, CoinShares’ head of research, pointed out that recent price increases in the market have pushed the total value of assets under management for digital asset ETPs to $98.5 billion.

Positive sentiments

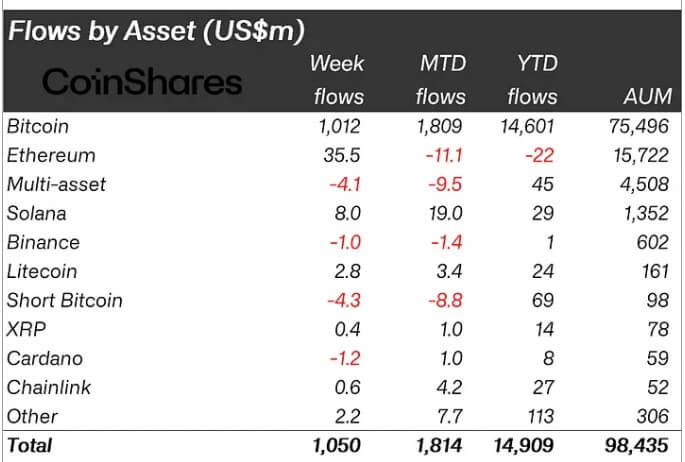

A flow breakdown shows that Bitcoin-related ETPs accounted for 99% of the total inflows, recording $1.01 billion last week. Surprisingly, short Bitcoin products saw another week of outflows, totaling $4.3 million.

Butterfill explained that the substantial inflows into BTC ETPs showed positive sentiments returning to the market. He wrote:

“[The inflows] suggest that sentiment is turning broadly positive despite the recent price rises. This is likely due to investors interpreting the FOMC minutes and recent macro data as mildly dovish.”

These positive sentiments also extended to Ethereum-related investment products, which saw their highest inflows at $36 million since March. Butterfill stated that these inflows “were likely an early reaction to the approval of ETH ETFs in the United States.”

Notably, other large-cap digital assets, like Solana, Chainlink, and Litecoin, recorded cumulative inflows exceeding $10 million during the reporting period.

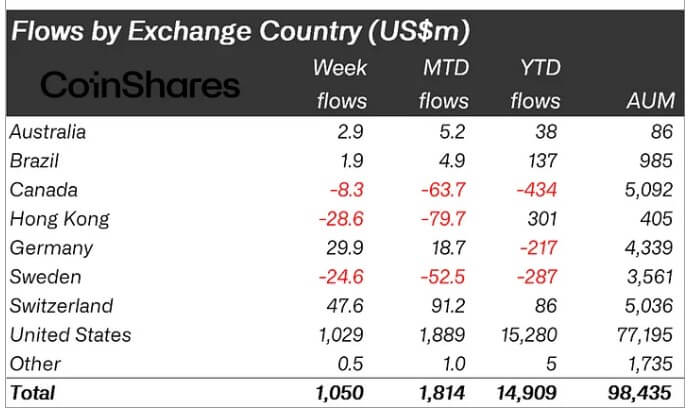

While sentiments in the United States appear to impact investors’ interests in crypto products positively, the same cannot be said for ETFs in Hong Kong.

According to CoinShares, since the initial positive launch of Bitcoin spot-based ETFs in Hong Kong (which saw $300 million in the first week), there have been further outflows of $29 million last week. This brings the total outflows in the city-state to approximately $80 million this month, the highest among countries.