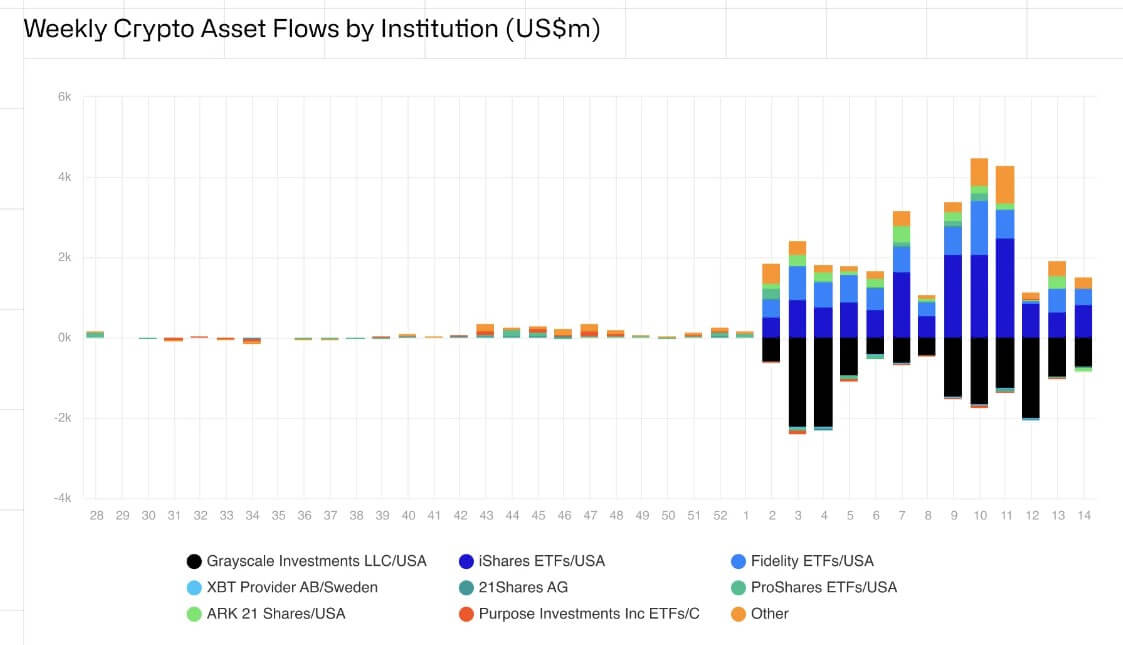

Investor fervor for Bitcoin ETFs cools despite $646 million weekly surge in crypto funds

This inflow brings the total for the year to an unprecedented $13.8 billion, propelling the total assets under management to a staggering $94.47 billion.

Bitcoin ETF hype moderating

Trading volume for crypto investment products declined last week, dwindling to $17.4 billion from the $43 billion recorded in the first week of March. This suggests a potential moderation in investor interest in Bitcoin exchange-traded funds (ETF) after weeks of consecutive hype.

Meanwhile, Bitcoin remains the focal point for investors, maintaining its market dominance since the ETF approvals in January. During the past week, BTC-related products witnessed a substantial positive net flow of $663 million.

The lion’s share of this inflow came from BlackRock’s iShares, which amassed $811 million, with Fidelity FBTC following at $395.83 million. In contrast, Grayscale GBTC recorded $731 million in outflows.

While Bitcoin products flourished, outflows from other digital assets caused the total net flow to dip to $646 million. Ethereum witnessed its fourth consecutive week of outflows, shedding an additional $22.5 million. Consequently, ETH’s year-to-date net flows have dropped to $52 million.

Conversely, select altcoins demonstrated resilience. Solana, Litecoin, and Filecoin attracted notable inflows of $4 million, $4.4 million, and $1.4 million, respectively.

Moreover, the current bullish sentiment in the market resulted in short Bitcoin products experiencing their third consecutive week of outflows totaling $9.5 million. This reflects a waning conviction among bearish investors, especially as BTC’s price jumped by approximately 4% during the past week to over $70,000 as of press time.

Despite the “moderating” appetite for Bitcoin ETFs, the United States retained its position as the leading market, with inflows totaling $648 million. Brazil, Germany, and Hong Kong also witnessed substantial inflows of $9.8 million, $9.6 million, and $9 million, respectively.

Conversely, Canada and Switzerland experienced outflows of $27 million and $7.3 million, respectively, underscoring regional variations in market sentiment.